WEF Session Highlights Japan’s Push for AI, Semiconductors and Productivity Revival

Dubai: Japan’s new government is seeking to chart a decisive break from decades of deflation and cost-cutting by prioritising large-scale investment in strategic technologies, resilient supply chains and productivity growth, Finance Minister Satsuki Katayama said during a World Economic Forum (WEF) session on the country’s economic future.

Speaking at the discussion titled “How can we unlock new sources of growth? Japan’s Turn,” Katayama said the country stands at a “dramatic moment” as Prime Minister Takaichi Sanae’s administration looks for a fresh mandate following this week’s announcement dissolving the lower house.

“She will take on three major policies and put them to the choice of the Japanese people,” Katayama said, outlining an approach aimed at reviving growth “through responsible and proactive public finances.”

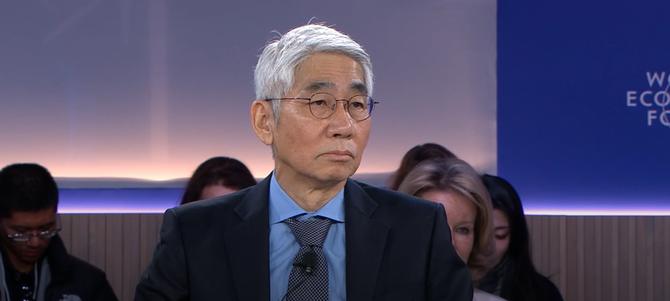

The session, moderated by Financial Times columnist Gideon Rachman, brought together senior political and business leaders to assess whether Japan’s recent economic momentum can be transformed into sustainable long-term growth in the face of demographic decline and mounting geopolitical pressures.

Katayama pointed to what she described as clear signs that Japan is emerging from its prolonged deflationary period, citing stronger confidence, rising investment and sustained wage growth.

“Japan’s nominal GDP has surpassed 4 trillion US dollars. Capital investment is at a record high, and wages have risen over five percent for two consecutive years,” she said, adding that the Nikkei stock average is now “about five times its 2012 level.”

“These results show Japan is shifting from a deflationary, cost-cutting economy to a dynamic, growth-oriented one driven by bold investment and productivity gains,” she added.

She also highlighted improving public sentiment, particularly among younger citizens, noting that confidence in politics has increased sharply and that “almost 50 percent viewed Japan’s future as bright.”

According to Katayama, the government’s growth strategy centres on large-scale public-private investment in areas critical to economic performance and national resilience, especially as Japan’s population continues to shrink.

“Achieving a strong Japanese economy requires strategic fiscal action based on responsible and productive public finances,” she said. “We aim to lift incomes, restore consumer confidence and create a richer cycle of improving corporate profitability.”

Among the priority sectors identified were semiconductors, artificial intelligence and robotics.

Katayama also addressed Japan’s delicate geopolitical position between the United States and China, describing the pressure as a long-standing reality.

“We are between the United States and China and we cannot move geopolitically,” she said. “The United States is the only country with which we have a national security treaty.”

She noted that Japan continues to face restrictions from China “without any good reason,” while cooperation with the US and G7 partners remains strong, particularly on critical minerals and supply-chain resilience.

Former Australian prime minister and current ambassador to the United States Kevin Rudd said Japan is widely viewed across the Indo-Pacific as a stabilising economic and strategic force.

“The rest of the Indo-Pacific is very bullish about Japan,” Rudd said. “Japan is seen as a force for strength, for stability, and increasingly for prosperity.”

He added that Japan’s drive into AI and advanced manufacturing would enhance regional resilience, stressing the need to broaden supply chains for semiconductors and critical minerals beyond a limited number of producers.

“Those of us who succeed and adapt to the AI universe will prevail,” Rudd said.

From a corporate perspective, NEC president and CEO Takayuki Morita said Japan’s shrinking workforce makes the adoption of AI and robotics less socially contentious than in many other economies.

“Japan is suffering from a shortage of workforce,” Morita said. “Everybody is happy to get robotics and AI into the real world.”

He argued that Japan has a comparative advantage in applying AI to real-world industrial and infrastructure settings, particularly through the use of proprietary and physical data rather than internet-based models alone.

“Japan is one of the few countries that can develop large language models from scratch,” Morita said, adding that this positions the country to contribute to global technological stability beyond the US-China rivalry.

However, some business leaders cautioned that structural and cultural barriers remain. Mazen Darwazeh, executive vice-chairman of Hikma Pharmaceuticals, said Japan’s innovation strengths have not always translated into openness for foreign companies.

“Japan is a first-class country with first-class technology, but at the same time, it is a closed society whereby it’s difficult for outsiders to do business,” he said.

Darwazeh also pointed to regulatory hurdles in pharmaceuticals and clinical research, arguing that greater openness would be essential as Japan grapples with demographic decline and intensifying global competition.